FAQs about 2026 Property Assessments

What is the aim of the green card?

Accuracy. State law requires the municipality to assess the “full and true value” of all real property. The green cards show each property owner the results of the municipality’s mass-appraisal system--- ahead of the assessment roll being set---both for transparency, and so property owners can work with property appraisal to make any justified corrections.

Are property values unusually up this year?

Overall, no. The average change was +4.3%. The majority of properties (58%) changed by less than 5%. Approximately one-third of properties (32%) saw valuation decreases. But some properties did see large adjustments—10% of properties were adjusted by more than 10%.

Are large adjustments unusual?

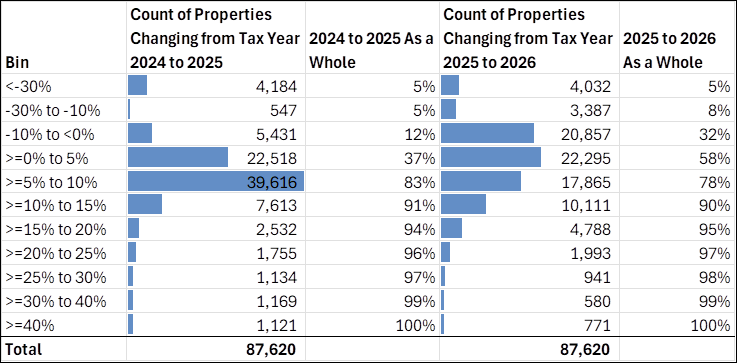

The adjustments we’re seeing this year aren’t unprecedented. The chart below compares this year’s changes (right) to last year’s changes (left). The bell curve of changes this year is a little wider – but the percentage of properties (~9% to 10%) that received higher upward valuation changes (>=10%) is very similar.

Is this a political process?

No—property assessment is carried out by career professionals who apply generally recognized and legally required assessment practices.

Is there an incentive to inflate assessments to increase property taxes?

No, and for at least three reasons.

First---and primarily---because property assessments are conducted by career professionals whose only aim is to assess “full and true value,” without regard to any outside considerations.

But even if that were not the case, second, increased property values, on their own, would not lead to increased taxes overall because the municipality has a “tax cap.” Because [Property taxes] = [Assessed Value] * [Mill Rate], and the tax cap fixes the total amount of property taxes, increased property valuation, on its own, acts only to reduce mill rates, not increase taxes.

Moreover, as a result of the state school-funding formula, the state’s contribution to local schools actually decreases as property values increase—meaning that the amount of money available to fund general government can actually decrease as property values go up.

Why would a property assessment change by 30% or 40%?

Very large assessment changes are most typically associated with new construction (involving a new or significantly different structure being placed on a parcel of land) or other special circumstances.

Why did some properties see larger changes?

Each property is different. As noted in the prior response, some properties were previously under-construction or had significant on-the-ground changes; other properties may have been undervalued in previous assessment cycles.

Did the assessment methodology change?

Generally, no—the overall assessment framework used by property appraisal didn’t change. This year, like all previous years, the property appraisal used a “market-adjusted cost approach to value,” typical of an assessing jurisdiction. Among other things, the department looked at cost data; comparative sales; and quality of construction.

But property appraisal did refine some inputs to the model.

- The Cost Model uses as a significant input a “base value,” which was trued up using the best-available cost data. [Long ago, the Municipality adopted a base value of $93,950 which had been several times adjusted, until by 2025 the adjustment factor was 2.4133—suggesting we were overdue for a true-up. For 2026, the department used new data from Marshall and Swift (the leading vendor,

https://www.cotality.com/products/marshall-swift) to arrive at an updated cost base of $221,832, which was then adjusted to market data (by applying a Cost Factor of 1.18).]

- For comparative sales, the department adopted more defensible “market areas,” after consulting with a certified assessment evaluator who advised on best practices and standards from the International Association of Assessing Officers (IAAO). The update replaced what, over time, had become an “obsolete neighborhood structure, which consisted of 430 neighborhoods in 27 groups” that was becoming increasingly difficult to administer because “with a decreasing number of reported annual sales, most neighborhoods had insufficient data to develop supportable market adjustments.”

The previous approach “stratified” neighborhoods into fragments, in which adjacent properties were treated quite differently, and was outside of national norms. By way of example, compare the treatment of Turnagain in the old system (left) to the revised structure (right):

- Last, to attend to differing quality of individual houses, Property Appraisal applies a “grade factor.” Prior to this year, the municipality used a “[multi]-level grade system [that] was over-stratified and applied inconsistently.” It was refined into a system of three grades, based on “[Marshall and Swift] standards and market analysis of [assessed value to market value] AV Ratios.”

In practice, each of the updated inputs was designed by property appraisal to make the assessments more accurate and defensible, and to better incorporate data from neighboring properties.

Did these changes have to happen?

Property appraisal is always working to improve its processes. This year’s changes better align with

International Association of Assessing Officers standards, and were made with awareness of recent changes to state law (via SB 179, signed into law in August 2024) that require municipalities to “determine . . . full and true value as provided in standards [to be adopted by the State Assessor or local ordinance] . . . that are not inconsistent with standards adopted by the International Association of Assessing Officers.” AS 29.45.110.

Could the refined inputs to property appraisal’s assessment framework have resulted in a change to an individual property’s assessment?

Yes—but the valuation of all properties reflects property appraisal’s best understanding of the property’s “full and true value.”

How can homeowners be reasonably assured that their assessment is accurate?

Assessments are developed in accordance with

International Association of Assessing Officers standards and are tested to ensure accuracy and equity. However, the best way for homeowners to be confident their assessment reflects their specific property is to review their property record online and contact Property Appraisal with any questions or concerns.

Is there a report that shows property tax increases/decreases by area?

Yes. Slide 13 of property appraisal’s

Annual Valuation Report summarizes average assessment changes by Assembly District. For a more granular review, the public can view property-level assessment increases and decreases through the

Open Data Portal.

Is property appraisal looking at property that changed by a significant amount?

Yes. Mayor LaFrance instructed property appraisal to proactively review areas where valuation of parcels changed by large amounts.

Is property appraisal identifying corrections that need to be made?

Yes. Property appraisal receives inquiries about assessments every year, and every year makes justified corrections. That process is occurring now and will continue over the coming weeks.

What is happening now?

As it does every year at this time, the assessor’s office is working with property owners who called 907-343-6500 to complete informal reviews of properties. There is no fee for the process.

At the mayor’s direction, the assessor’s office is also proactively looking at areas of the municipality that saw significant valuation increases and determining whether the incoming calls are surfacing an underlying pattern.

Is the Assessor’s Office making any corrections?

Yes, the Assessor’s Office makes necessary corrections every year.

Additionally, at the Mayor’s direction, Property Appraisal proactively reviewed groups of properties that experienced notable increases.

This review identified four neighborhoods – Goldenview Park, Sahalee, Lookout Landing, and Leary Bay – where some groups of properties warrant the issuance of revised valuation notices. About 660 homes will receive new, lower, assessments because of this proactive review. This is less than 1% of the total assessed properties in Anchorage. The Assessor’s Office’s ongoing review has generally confirmed the accuracy of its assessments.

What neighborhoods are receiving corrected assessments?

Leary Bay, Bonnie Cusack Subdivision, and Lookout Landing in West Anchorage; and Sahalee and Goldenview Park in South Anchorage.

Why the change?

The assessor’s office determined that parcels in the neighborhood had been over-assessed.

What caused the over-assessment for the four neighborhoods?

To arrive at an assessed value for a property, the assessor’s office looks at cost-of construction, comparative sales, and quality of construction.

In each of the four affected neighborhoods, the assessor’s office determined that affected properties had historically been assigned a quality-of-construction grade that was too high. The issue was masked in prior years, because the parcels were included in market areas that likely reduced final valuations. The Assessor’s Office made improvements to the market-area framework this year, causing the quality-of-construction grade issue to surface.

How many parcels are affected, and by what amount will assessments change?

About 660 homes will receive lower assessments. These corrected assessments have been mailed. On average, the homes receiving revised assessments saw an original increase of about 16%. They are now being lowered to an average increase of about 5%, which is right around the municipality-wide average of 4.3%

If a person believes their assessment is wrong, what should they do?

Contact property appraisal at (907) 343-6500. Property appraisal will work with property owners and review individual cases. This “informal review” often eliminates any need for property owners to file a formal appeal.

The Property Appraisal Division is experiencing higher than average call volumes. The Division aims to get back to callers in two business days, but given the high call volume, it may take longer.

Formal appeals to the Board of Equalization can be filed through the end of business on Feb. 11.

The informal review and formal appeal processes are an important part of ensuring accuracy and equity – and Property Appraisal relies on them just as much as property owners do. They are an opportunity for Property Appraisal to receive constructive feedback and additional data, and to improve the overall quality of its assessments.

What can I expect from an informal review?

An informal review is an opportunity to have a direct conversation with an appraiser to ask questions and discuss any concerns. Think of it as a "first look" that can help you decide whether to file a formal appeal.

A value change is not guaranteed. While corrections happen in some cases, many informal reviews do not result in a lower assessment. This is because our informal reviews are limited in scope. They are not a full re-evaluation of market value or an in-depth analysis of your property.

During an informal review, the appraiser will listen to your concerns and do a brief check of your property records. They can look at any simple information or evidence you provide, such as:

- Recent sales: Documentation showing you bought the property on the open market recently.

- Data errors: Incorrect square footage, bedroom counts, or year built, etc.

- Condition issues: Photos or reports showing the property was sold "as-is" or has significant damage.

Inspections: We usually don’t visit the property for informal reviews. However, we may require a physical inspection when the issue involves conditions that can't be verified through existing records or the documentation you can provide.

If your situation is complex or requires an in-depth analysis or verification that goes beyond simple corrections, you will likely be directed to the formal appeal process. This ensures your case gets the time and detailed review it deserves.

Do residents need to pay a fee to ask property appraisal to review an assessment?

No, there is no fee associated with contacting property appraisal to seek an initial review.A refundable deposit is required for filing a formal appeal to the Board of Equalization. This fee is meant to secure a property owner’s participation in the appeals process and is fully refundable for those who participate. In 2025, 92% of these deposits were refunded. For more information on the formal appeals process, see:

https://www.muni.org/Departments/finance/property_appraisal/HowDoI/Pages/Appeals.aspx

Can the Assembly extend the appeal deadline?

No. Unless you received a new green card, the deadline to file a formal appeal was February 11. That deadline is set by a function of state law and cannot be extended.

However, under the municipal code, a property owner who missed the appeal deadline may request permission to file a late appeal by submitting a written request to the Assessor within 30 days after the appeal deadline. The Board of Equalization (BOE) must then determine whether compelling circumstances prevented the property owner from filing on time.

Assembly Resolution 2026-34(S) does not change this two-step process. It creates a presumption that compelling circumstances exist if a property owner attempted to contact the Assessor’s Office before the February 11 deadline but did not receive a response in time.

For properties that did not receive a new green card, March 11 is the deadline to request to file a late appeal. If the BOE grants the request, the property owner has 30 additional days from the time BOE grants the request to file the appeal.

Can I compare the old to the revised market areas?

Yes. There is a map that compares the old and new market areas. You can access the map by clicking here.

I appealed my property. When will I hear from Property Appraisal?

Property Appraisal anticipates shifting the primary focus to formal appeals in late February or early March. At that time, appraisers will begin contacting property owners who filed appeals to review their concerns, consider any information submitted, and explain the next steps in the process.

Given the volume of appeals this year, the overall timeline may extend longer than a typical year. We appreciate your patience and are committed to moving cases forward as efficiently and equitably as possible.

Where can I get more information?

More information is available at property appraisal’s website (https://www.muni.org/Departments/finance/property_appraisal/pages/default.aspx), including: FAQ's About My Property