Program Taxes and Surcharge

Special municipal sales and excise taxes and the E911 Surcharge are administered by the Revenue Management Section of the Treasury Division. If you have any questions, please contact us between 8:00 am and 5:00 pm, Monday through Friday, excluding holidays.

Online payments will be processed through Forte Payment Systems, a third-party vendor that is fully integrated within eGov service. The processing fee for all electronic checks will be as follows:

- $0 to $50,000.00 fee is $1.75

- $50,000.01 to $75,000.00 fee is $3.00

- $75,000.01 to $150,000.00 fee $10.00

- $150,000.01 to $250,000.00 fee is $15.00

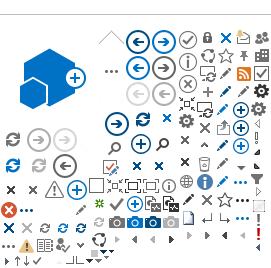

eGov Registration, Filing and Paying Instructions

Staff Telephone Numbers

Tax Enforcement Officers I:

Tax Enforcement Officers II:

- (907) 343-6682

- (907) 343-6757

- (907) 343-6964

Supervisor: (907) 343-6965

Fax Number: (907) 343-6677

Email: WWPT@anchorageak.gov