FAQ's about the Exemption Review Process

The Exemption Review team is a section of the Property Appraisal Division with the Municipality of Anchorage. We are responsible for reviewing property exemptions to ensure they are applied fairly and adhere to both State Statutes and Municipal Code.

The Exemption Review team reviews the following types of exemptions:

- Residential

- Senior Citizen

- Disabled Veterans

The goal of this process is to ensure each homeowner who is eligible for an exemption receives one, while simultaneously identifying and removing exemptions that are no longer applicable.

The Exemption Review section is open Monday-Friday from 8am-5pm, and is located in City Hall at 632 W. 6th Avenue, #300. We can be reached via email at

propappex@anchorageak.gov or phone (907)343-6700.

If you received a letter regarding your exemption status, it is important that you contact our office within 30 days.

What is the review process? Will I receive a letter?

Why did I receive a Property Tax Exemption Status letter?

What can I expect during the review process?

Do I have to receive a PFD in order to qualify?

Why do I have to prove my residency and permanent place of abode?

Why do I have to reside in Alaska for 185 days each year to receive an exemption?

How do I prove my residency and permanent place of abode?

My exemption has been removed, what do I do now?

I never received a letter, why was my exemption removed?

I didn't know I was receiving an exemption, and now I'm being told I might lose it...

I run a small business out of my home. Does this disqualify me from receiving an exemption?

How many years of exemptions will be removed?

How much will I owe if my exemption is removed?

Does the Exemption Review Team only remove exemptions?

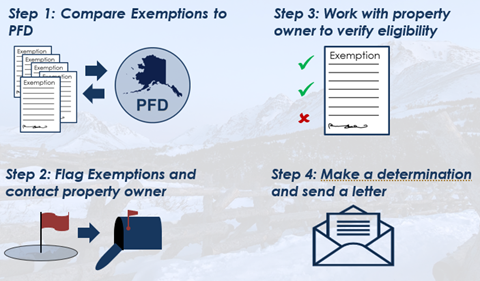

There are over 45,000 residential exemptions and over 18,000 senior/disabled veteran exemptions in the Municipality. Our review process can be broken down to four phases as depicted below:

Our review process starts with comparing our current exemption information to the State of Alaska Permanent Fund Dividend (PFD) database. If something doesn't look quite right, we will flag the exemption for further review. After the exemption is flagged, we will send the property owner a letter. This letter will explain the review process and ask the homeowner to contact the Property Appraisal office to discuss their exemption.

Once we make contact with the property owner, we usually look to confirm that they are still eligible. Generally, the following information is what we look for:

- Ownership

- Residency/Permanent Place of Abode

- Property use, e.g., rental of the property

After reviewing all information and follow up documentation provided by the homeowner, a determination will be made regarding the eligibility of the exemption. A final determination letter will be sent to the homeowner, who has 30 days to dispute the decision before it is considered final.

If you received a letter regarding your exemption status, it is important that you contact our office within 30 days.

We can discuss specifics as to what is required to confirm your exemption status.

Why did I receive a Property Tax Exemption Status letter?

There are many reasons a homeowner may receive a letter. Some common reasons are:

- Homeowner did not receive a Permanent Fund Dividend (PFD) at the site address for the years in review

- Homeowner's name changed

- Property was placed in trust

- All or part of the property appears to have been rented

None of these reasons automatically disqualify a homeowner from receiving an exemption, but they do require additional documentation before a determination can be made.

If you have received an exemption review letter, it is important that you contact our office within 30 days.

What can I expect during the review process?

The review process can take approximately 30 days from initiation to verification or removal, but ultimately depends on the responsiveness of the homeowner. If a homeowner is able to quickly verify their residency, the process is complete. If the homeowner is unable to provide proof of residency, or does not respond at all, the exemption will be removed at the end of the 30 day period, and a removal letter will be sent.

If you have received an exemption review letter, it is important that you contact our office within 30 days.

Do I have to receive a PFD in order to qualify?

No, not receiving a PFD does not automatically disqualify a homeowner from receiving an exemption, but it does require additional documentation before a determination can be made. If you have received an exemption review letter, it is important that you contact our office within

30 days.

Why do I have to prove my residency and permanent place of abode?

For a residential, senior, or disabled veteran exemptions, Municipal Code

section 12.15.015 requires the property to be owned and occupied as the primary residence and permanent place of abode of an eligible applicant for at least 185 days each year.

Why do I have to reside in Alaska for 185 days each year to receive an exemption?

The Municipality of Anchorage (MOA) relies on the State of Alaska Permanent Fund Dividend (PFD) database to confirm residency for eligibility. State statute allows Municipalities to use the PFD as a requirement for eligibility under

AS 29.45.030 (f).

In addition, MOA code requires property owners to reside in their dwelling for at least 185 days to qualify (AO 2003-149). The Senior Citizen Advisory Commission recommended the 185-day requirement back in 1998.

Today the policy goal remains: We want people to “live, work, and play" here in Anchorage (Anchorage 2040 Land Use Plan). Ultimately, the intent is to incentivize homeowners who live in the Municipality and contribute to our local economy.

How do I prove my residency and permanent place of abode?

There are multiple forms of documentation accepted to prove residency and permanent place of abode. Any document provided must list the site address as your physical address.

| Acceptable Supporting Documents | Unacceptable Supporting Documents |

| Proof of previous year PFD paid | Utility Invoices |

| Point of Sale transactions on Credit Card or Bank Statements | Check Images |

| Car Registration | Hunting/Fishing/Business License |

| Voter Registration | W-2 |

| Employment Verification Letter | Pay Stubs |

| Licensed Health Care Provider Medical Treatment Verification | Mortgage Statements |

| Extended Care/Nursing Facility Verification | Insurance Statements |

| ** All documents must reflect the site address ** |

My exemption has been removed, what do I do now?

An exemption is only removed after a thorough review. We provide a 30-day waiting period from the time of the initial letter to give the homeowner time to respond and provide the necessary documents to verify the exemption status. Once an exemption is removed, a second letter is sent, and we allow 30 days for the homeowner to appeal. After the 30 day appeal period, the determination is considered final.

Having an exemption removed does not disqualify you from future exemptions. If you believe you are still eligible for an exemption, visit our Property Appraisal website under

Exemptions to find information about reapplying for future years.

I never received a letter, why was my exemption removed?

Property Appraisal utilizes the mailing address on record as our primary form of contact. It is the responsibility of the homeowner to ensure their information is up to date. Please contact our office to update or confirm your personal contact information. You can also access our

Change of Address form on the Property Appraisal website.

I didn't know I was receiving an exemption, and now I'm being told I might lose it…

Many homeowners apply for an exemption shortly after purchasing their home. Most exemptions do not require an application each year, therefore it can be easy to forget that you receive one.

Exemptions can be viewed on the Property Appraisal website using the

Search Properties link year-round. They are also itemized on your annual tax bill.

Receiving an exemption is a great benefit to homeowners, but it comes with it's own set of responsibilities. It is the responsibility of the homeowner to notify Property Appraisal when their circumstances change to determine if there will be an adjustment to their exemption status.

Some common examples of status changes are:

- All or part of the property is being rented

- Applicant no longer resides in the property for 185 days per year

- Change in ownership

I run a small business out of my home. Does this disqualify me from receiving an exemption?

No, running a business out of your home does not automatically disqualify you from receiving an exemption. The exemption application asks if any part of the home is rented, or used for commercial purpose. If you answer “yes", we will ask for some additional information in order to determine if you will continue to qualify for an exemption.

How many years of exemptions will be removed?

Municipal Code 12.15.015 C.(6) states “If the assessor determines a property is not eligible for an exemption, all taxes, penalty, and interest due for all tax years beginning the year the property should have been subject to taxation shall be due and owing."

The Exemption Review team evaluates the current year, plus 6 previous years. The exemption can be removed for each year that the homeowner is found to not qualify for the exemption.

How much will I owe if my exemption is removed?

Once an adjustment is made to an exemption, the information is sent to the Property Tax section to be billed. The Property Tax team is responsible for all tax and billing activity related to exemptions. They are open Monday-Friday from 8am-5pm, and are located in City Hall at 632 W. 6th Avenue, #300. They can be reached by phone at (907)343-6650.

Does the Exemption Review Team only remove exemptions?

No, in addition to reviewing and removing erroneous exemptions, the Exemption Review Team reaches out to homeowners who may be eligible for a new exemption, but have no yet applied.

Once a year, we send a letter to any homeowner who currently has a Residential Exemption, who also meets the age requirement for the Senior Citizen Exemption. Since December 2019 we have sent approximately 2500 letters, resulting in over 1200 new Senior Citizen Exemptions.