FAQs about Appealing Assessments

The Property Appraisal Division is located in City Hall, 632 West 6th Avenue, Room 300. Office hours are 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding holidays. You may contact us by phone at

(907) 343-6500.

Prior to filing an appeal

Filing an appeal

Click

here to pay your Appeal Deposit online with ACH or Credit Card! (Please note: Processing fees are not refunded with the deposit upon conclusion of the appeal.)

Working the appeal

Board of Equalization

Prior to filing an appeal

I just received my valuation notice and I have some questions/concerns. What do I do?

Real Property assessment notices (green cards) will be mailed by January 15th each year. If you have any questions or concerns, start by contacting Property Appraisal during the 30-day review period. The 30-day review period starts from the mailing date of the valuation notice. The review period is a good time to ensure the property profile is correct, discuss a concern with an appraiser, correct errors, or file a formal appeal on your real property assessment. Generally, the earlier you contact Property Appraisal, the better we can serve you. We are located at City Hall, 632 West 6th Avenue, Room 300. Office hours are 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding holidays. You may contact us by phone at

(907) 343-6500. You may access your property profile by using the Property Appraisal Parcel Search tool at

http://www.muni.org/pw/public.html.

Return to Top

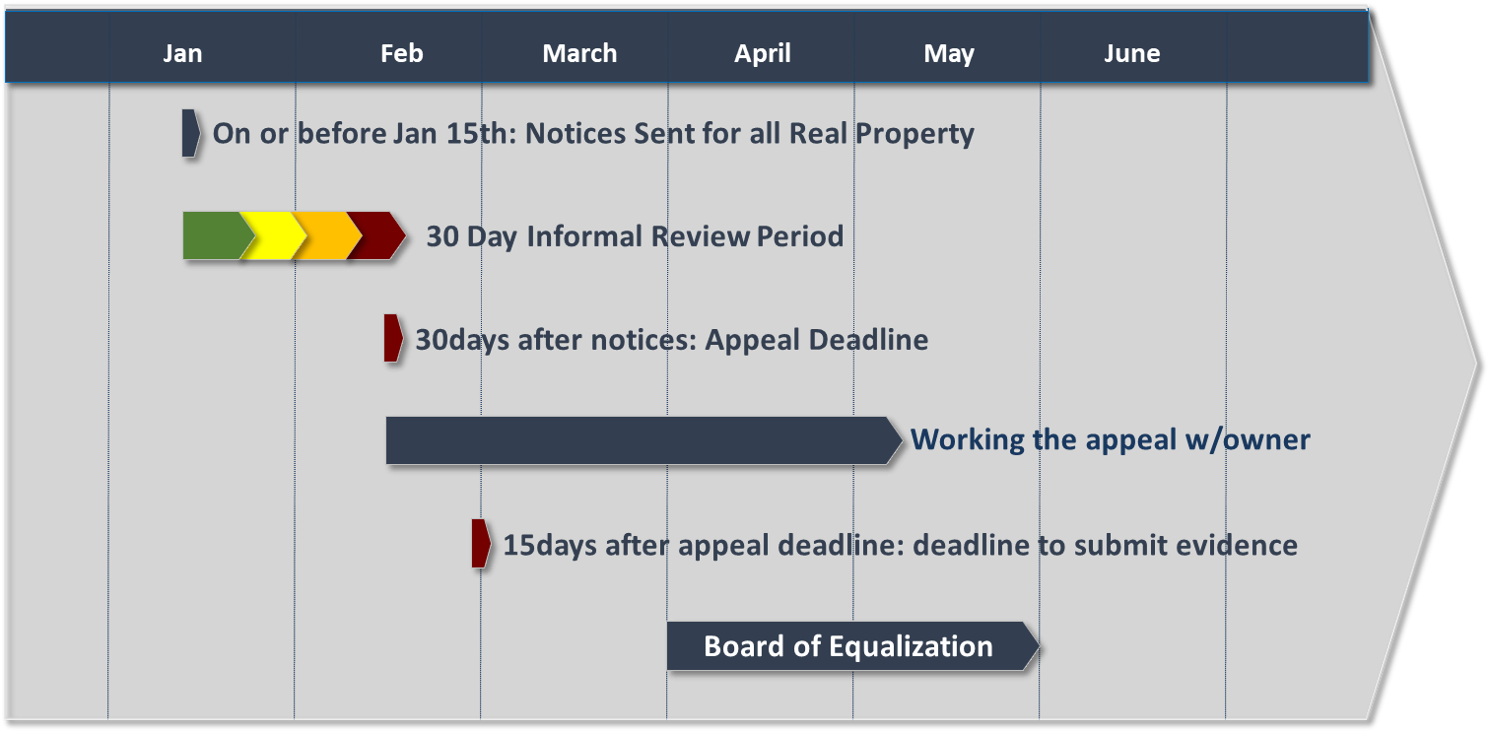

What is the timeline of the Appeal Process?

The valuation notices must be sent out on or before January 15th. The timeline following that date is shown in the graphic below. Mailing the notices kicks off a series of dates and deadlines. The first event is the 30-day review period where property owners can often resolve issues without the need for filing a formal appeal. The deadline to file an appeal is 30 days after notices are sent. This deadline is printed on your valuation notice. Upon filing a formal appeal, following the review period, an appraiser will be assigned to your case and you will be working collaboratively one on one towards a resolution. Fifteen days after the deadline to submit all formal appeals, is the deadline to submit any additional evidence which you feel supports your claim of an alternate value. Any evidence you wish to submit after the fifteen-day additional evidence period or any extension of the fifteen-day period may or may not be accepted at the Assessor's discretion. Starting in April the Board of Equalization hearings commence, and per Alaska statute all hearings must be substantially complete by June 1st.

Return to Top

Filing an appeal

How do I appeal the assessed value of my property?

To file an appeal of the Assessor's valuation of your property you must complete a written appeal form specifying the grounds for the appeal and pay a refundable filing deposit. The form and deposit must be filed within 30 days from the date the assessment notice was mailed. You may pay the deposit by cash, check or online with credit card or e-check

before the appeal deadline. Click

here to pay your Appeal Deposit online with ACH or Credit Card. Online payments will be charged a non-refundable convenience fee. The filing deposit will be refunded if the appeal is resolved prior to the hearing, or if you have provided the data and access required by the Assessor and you appear at the hearing. If the case is presented to the Board of Equalization, they will make a determination of the deposit following their decision.

It is always a good idea to review the information available at the Assessors Office or our website before filing an appeal. Information available may include your property description, sales of properties that are similar to yours, and values of property in your neighborhood.

Appeal filing deposit schedule:

|

Assessed Value |

Filing Deposit |

| $1 - $99,999 | $30 |

| $100,000 - $499,999 | $100 |

| $500,000 - $1,999,999 | $200 |

| $2,000,000 or greater | $1,000

|

Click

here to pay your Appeal Deposit online with ACH or Credit Card! (Please note: Processing fees are not refunded with the deposit upon conclusion of the appeal.)

Return to Top

Who may appeal the assessed value?

A person whose name appears on the assessment roll as the owner of record as of January 1 of the current year, or the agent, or assigns of that person may request an informal review or a formal appeal to the Board of Equalization within the aforementioned timeline.

Return to Top

May I appeal the amount of my property taxes?

No, appeals may only be made against the value of the property. The percent or amount of change from last year, amount of tax, mill rate, and other matters unrelated to the current valuation cannot be considered.

Return to Top

What is the deadline for filing an appeal?

Appeals must be filed within 30 days from the date the assessment notice (green card) was mailed. Real Property assessment notices are mailed in mid January each year. Appeals must be received by the Property Appraisal Division, or postmarked, by the

“Appeal must be filed by” date shown on the face of the assessment notice.

We encourage you to visit or contact an appraiser at Property Appraisal to discuss the valuation prior to filing an appeal. You may contact us by phone at

(907) 343-6500.

Return to Top

Where can I get an Appeal Form?

Appeal Forms may be obtained by contacting the Property Appraisal Division or here on our website (Real Property Appeal Form) (Personal Property Appeal Form).

Return to Top

Working the appeal

What happens after I file my appeal?

Your appeal will be assigned to an appraiser for review following the informal review period. You will be notified of who has been assigned your appeal and how to contact them. You must provide the appraiser with your evidence within 45 days of the date notices (green cards) were mailed. The appraiser may require further information and/or an inspection of your property. Once the appraiser reviews the information or performs any requested property visit, the appraiser will make a value recommendation, and you will receive an 'Appeal Withdrawal Form' noting the recommended value. If you sign the Withdrawal Form your appeal will be finalized at the recommended value, and you will get your appeal deposit back; approximately 75% of appeals are resolved in this manner. If you choose not to sign the Withdrawal Form, your appeal will be scheduled for a hearing at the Board of Equalization (BOE). You will receive a notification for the hearing two weeks prior, and you will receive an appeal packet including a copy of your appeal and a summary of the Assessor's position that will be presented to the BOE one week prior to the hearing.

Return to Top

What information must I provide with my appeal?

When submitting an appeal, provide the following:

- Parcel number of the property you are appealing;

- Specific reasons why you believe the Assessor's valuation does not reflect the value of the property (the amount of tax, percent of increase, personal hardship, and other matters unrelated to the value, are not sufficient grounds for appeal.);

- Comparable sales or other supporting evidence (see the list below); and

- Your signature (and agency authorization, if someone else will represent you).

- Complete both sides of the appeal form.

By Alaska State law, "THE APPELLANT BEARS THE BURDEN OF PROOF. The only grounds for adjustment of assessment are proof of unequal, excessive, improper, or under valuation based on facts that are stated in a valid written appeal or proven at the appeal hearing. If a valuation is found to be too low, the Board of Equalization may raise the assessment." Alaska Statute 29.45.210.(b)

You must present clear and convincing evidence to support your appeal. All evidence must be provided within 45 days from the date the assessment notice was mailed (30 days to file an appeal plus 15 days to provide all supporting evidence) . The Assessor may agree to extend the time limit to provide evidence under certain circumstances. Contact the assessor's office regarding any extention request. Appeals without supporting information will be dismissed by the Board.

New or additional documentation may not be introduced at the hearing.

Return to Top

Why is there a deadline for submitting evidence?

The Assessor is required to be substantially finished with all Real Property appeals by June 1. Evidence supporting the appeal must be submitted in a timely manner in order to timely review each case, make appropriate adjustments to value, and to prepare the appeal to be heard by the Board of Equalization.

Return to Top

What kind of evidence should I provide for my appeal?

The assessed value is the assessor’s estimate of the price the typical buyer would pay for your property as of January 1 of the assessment year. Buyers and sellers create market value through their activity in the marketplace.

- In a

residential appeal the best evidence of market value is sale price, the sale price of the subject property, and of similar properties.

-

Commercial properties may require rent rolls, leases, and income and expense information.

You may obtain comparable sales information from local realtors, appraisers or at the Assessors Office. If possible, select sales of properties that have sold recently, are most similar to your property, and are in your neighborhood or area. For each comparable you use,

be sure to include the parcel number and address, as well as

date of sale and sale price. Also consider comparable characteristics of the property.

Typical characteristics to consider include:

Land Characteristics

- Location (nearby sales are best)

- Units of comparison (square footage, acreage, front feet)

- Zoning

- Desirable features (view, waterfront, good access, etc.)

- Undesirable features (poor access or soils, steep topography, etc.)

- Wetlands

- Utilities

Building Characteristics

- Type of construction (wood, brick, etc)

- Square footage (finished vs. unfinished)

- Building condition, quality and age

- Number of bedrooms and bathrooms.

- Amenities (garage, fireplace, workshop)

- Type of property (single family, duplex, warehouse, etc.)

Other Supporting Evidence

- Property inspection by an MOA appraiser

- Appraisals prepared by others

- Listing information and price

- Closing statements for your purchase

- Documentation by others concerning problems (engineers, inspectors, etc.)

- Contractors itemized estimates for repairs

- Income and expense information, if subject is an income property

NOTE: Documents you wish to be considered as evidence must have been filed with the assessor within 45 days of the date assessment notices (green cards) were mailed, unless the Assessor agrees to an extension. New or additional documentation may not be introduced at the hearing.

Return to top

Board of Equalization

What is the Board of Equalization?

The Board of Equalization (BOE) is comprised of private citizens and local professionals who have been appointed by the members of the Anchorage Assembly to hear valuation appeals brought forward by property owners. The BOE is not an advocate for the Municipality nor the property owner. The BOE reviews appeals for unequal, excessive, improper, or undervaluation based on the facts stated in the appeal or proven at the hearing. The BOE is not part of the Municipal Assessors Office, the Assessor's office provides clerical support staff to the BOE.

Return to Top

When will I have a hearing?

You may check for the scheduled hearing date on our website Appeals Schedule. The Property Appraisal Division will also notify you of the location, date, and time of your hearing; approximately two weeks in advance of the hearing date. If you fail to appear, the hearing may proceed in your absence unless the BOE grants a new hearing date.

Return to Top

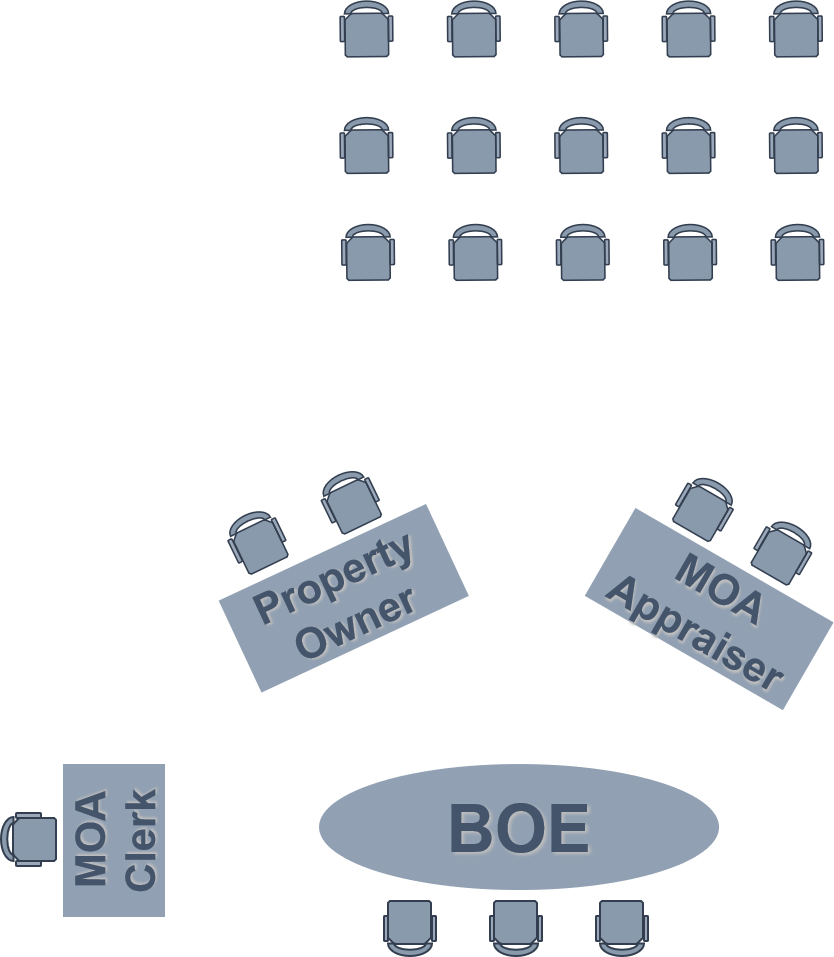

What can I expect at the hearing?

The Board of Equalization (BOE) hearings are available to the public. BOE hearings are scheduled two weeks prior to the hearing for either the morning session or afternoon session. Once you walk into the BOE room (layout of BOE room shown below), you will be asked to sign in on a first come first serve basis. The chair of the BOE will call each appeal for a hearing. Once your appeal is called, you will be asked to walk to the property owner desk where you will be sworn in by the clerk. All testimony before the BOE shall be recorded under oath. The BOE typically allows the property owner five minutes to testify on the issues of the case followed by five minutes of testimony by the appraiser and then an additional five minutes back to the property owner to allow a rebuttal from the issues put forth by the Assessor's Office. During testimony, the BOE may ask questions to the property owner and or the appraiser. Municipal code requires that all evidence should have been submitted to the Assessor's Office prior to the hearing and that if full access to property or records has been denied; issues affected by that access will be decided in favor of the Assessor. Typically, new evidence will not be accepted, but you may give oral testimony to the evidence. Once the testimony is closed the BOE will make a determination on the value.

The BOE may lower, raise or uphold the value in question. A written letter of determination will be sent to the contact address on the Appeal Form. A decision by the Board regarding your appeal is only applicable for the tax year in which an appeal is filed. The Assessor is not bound by the Board's decision in a subsequent assessment period (the following years valuation). It is therefore important for you to review your assessment notice each year. If you disagree with your assessment you should contact the Assessor's Office or file an appeal for that year.

Return to Top

How to Prepare for the Board of Equalization

The path to the Board of Equalization began with your timely filing of a valid appeal (within 30 days of your green card called the Real Property Assessment Notice).

You provided specific reasons for the appeal supported by clear evidence. You worked with the assigned Sr. Appraiser or Analyst from the MOA, and an inspection may have been performed.

As you enter the scheduled hearing process, you should prepare to speak to your reasons for appeal and the evidence that supports your opinion of value.

Tips to Prepare:

Read the BOE packet.

The BOE packet is a summary of all the evidence and correspondence that the MOA has gathered for your appeal.

-

It contains the evidence that you have provided, as well as the descriptive information that the MOA has considered in determining the value of your property under appeal.

-

The board of equalization will be familiar with the contents of this packet and if your evidence was submitted on time, it will be included in this packet.

-

This is the foundation of your appeal.

Understand the evidence process at the hearing.

If you plan to submit evidence at the hearing, be prepared that the Board of Equalization may decline to accept the additional evidence that was not submitted in time. This happens more commonly when the evidence is too lengthy to process at the hearing and required time to review in advance.

-

You may still verbally speak to your evidence, so prepare your summary statements ahead of time.

-

Long appraisal reports, environmental studies, some photography, and other lengthy documents are difficult to summarize verbally.

-

Best if those are submitted on time, but clear summarizing statements that communicate your point will be included in the audio recording.

Practice your testimony.

You typically get to speak for five minutes, then the MOA representative will speak for five minutes, and you will have 5 additional minutes to make any rebuttals.

-

This includes summarizing any evidence that you brought to the hearing and was not included in the BOE packet.

-

Practice will help you make a clear case that your evidence is persuasive.

Facts are better than feelings.

Understandably, assessment issues can get emotional, but…success is more common when appellants can make clear statements about evidence.

-

Prepare notes for yourself and follow them as you speak.

What if I am not satisfied with the Board of Equalization decision?

The appellant or the Assessor may appeal a final determination of the Board of Equalization to the Superior Court within 30 days of the Boards decision.

Return to Top

Should I wait until after my appeal hearing to pay my taxes?

No, pay your taxes when they are due. Taxes must be paid on or before the due date even if an appeal is pending. Taxes paid after the due date are delinquent and 10% penalty, plus interest and costs are added to the delinquent tax.

When a Board of Equalization appeal is finalized, and if there is a decrease to the assessed value, a refund will be issued for the excess taxes paid, plus interest. Refunds usually take several weeks to process.

An exception to the above requirements for payment of taxes applies only to:

- Residential zoned property for which the assessed value has increased by $50,000 or more from the previous year; or

- Commercial zoned property for which the assessed value has increased by $250,000 or more from the previous year;

and

- Municipal assessment records do not reflect new construction or remodeling has occurred on the property.

If your appealed property meets the above exceptions and the appeal has not been resolved on or before the due date for the first or second tax payment installment, a minimum payment shall be made by the due date for each installment. The minimum payment is based on the assessed value for the previous year and the mill rate for the current year. Contact the Treasury Division at

(907) 343-6650.

If your appeal is resolved and you owe additional tax, the balance, including interest shall be paid with the second half installment, or, if not resolved by the second half due date, within ten days of notice of resolution of the appeal.

Failure to make a timely payment for any balance due will result in application of both penalty and interest on the balance.

Return to Top